Traveling is an exciting experience, but for those with pre-existing medical conditions, it can come with added risks. Whether you have diabetes, heart disease, auto-immune issues, or another chronic condition, securing the right travel medical insurance is crucial to ensuring access to necessary healthcare and avoiding unexpected costs. We recommend that all travelers have adequate medical insurance for their travels. If your primary medical insurance does not cover your destination, travel medical insurance is often the best solution. The reality is that the majority of travel medical insurance plans DO NOT cover pre-existing conditions! Based on our personal experiences, here is our guide to how to buy travel medical insurance for pre-existing conditions.

This post may contain affiliate links. If you make a purchase through these links, we will earn a small commission at no additional cost to you. We recommend products we have personally used or verified. Read the full disclosure here.

Don’t have time to read this post? Search here for travel medical insurance!

Pin this post for later!

Understanding Pre-Existing Conditions

A pre-existing condition generally refers to any health issue diagnosed or treated before purchasing a travel insurance policy. Be sure to check the provider’s pre-existing condition details to confirm what is and is not included on their policy. Some common conditions often considered “pre-existing” include:

- Heart disease

- High blood pressure

- Diabetes

- Asthma / respiratory disorders

- Autoimmune diseases

- Recent surgeries or hospitalizations

Standard travel insurance policies often exclude coverage for pre-existing conditions, making it essential to search for specialized coverage before departure.

Why You Need Travel Medical Insurance for Pre-Existing Conditions

Medical care for pre-existing conditions while traveling can be costly and difficult to access if you don’t have the right insurance coverage. Here’s why investing in travel medical insurance with coverage for pre-existing conditions is critical:

1. Access to Necessary Medical Care

If you require urgent medical care, whether due to a pre-existing condition or not, a solid travel insurance policy ensures that you can receive necessary medical treatment without incurring excessive expenses. Keep in mind that people often step outside of their comfort zone while traveling. This could mean participating in an outdoor activity like skiing or hiking at high altitudes, or waiting in long lines in the hot sun to get into an attraction. For those with pre-existing conditions, these activities can trigger recurrence or flare-ups of existing conditions. It is better to be prepared with the proper insurance in case medical care is needed on your trip.

2. Emergency Medical Evacuation

Some conditions may require specialized care that is unavailable in your destination or even in your destination country. Comprehensive insurance can cover medical evacuation to a facility equipped to handle your needs.

Take travel to Switzerland, one of the more expensive medical destinations, as an example. Without insurance, an ambulance ride may cost more than 1,000 Swiss Francs, while an air ambulance can cost into the hundreds of thousands of Swiss Francs.

3. Prescription Medication Coverage

Running out of or misplacing essential medications while traveling can be a major concern. Certain policies cover prescription refills or assistance in obtaining necessary medications abroad.

Traveling with a type I diabetic in our family, we always calculate the number of supplies needed for our trip and add 25-50% extra in as a buffer. This allows for sufficient supplies in case our return flight is delayed a few days. Despite this, we’ve had our challenges over the years. We’ve found ourselves searching for backup insulin when the insulin we traveled was exposed to heat and wasn’t working effectively. We’ve since learned to use Frio packs to keep them cool. During a trip to Hawaii, the insulin pump sites fell off more frequently than normal due to the heat, humidity, and time in saltwater despite extra adhesive. Thankfully, we were able to get extra pump infusion sites delivered to us.

4. Hospitalization Costs

If you end up in the hospital or emergency room on your travels without proper insurance, medical bills can quickly become overwhelming. Insurance can significantly reduce these expenses, particularly in countries with costly healthcare systems. Given that those with pre-existing conditions have a higher probability of needing a visit to the hospital, it is that much more important to have proper insurance in place.

How to Find the Right Travel Medical Insurance

Here are the steps we take and recommend to search for travel medical insurance that covers pre-existing conditions:

1. Look for Pre-Existing Condition Waivers

As mentioned previously, most travel medical insurance policies do not cover pre-existing conditions. We use and recommend Squaremouth to shop for, compare, and purchase travel insurance coverage. One of the big advantages of this site is being able to filter easily and compare policies side by side.

- Be sure to book travel insurance shortly after you put your first deposit on the trip. Most companies who offer pre-existing condition coverage require that the policy is purchased within 7-10 days after the first deposit has been made on your trip.

- On Squaremouth, you will be prompted to enter your trip dates and traveler information, as well as the deposit date. Simply filter for those policies offering coverage for pre-existing conditions. We typically find 2-3 options max with pre-existing coverage.

The image below is a sample quote for a 1 month trip to Italy including pre-existing conditions and increased emergency medical and evacuation coverage. Note that trip cancellation insurance was not included.

2. Opt for Comprehensive Medical Coverage

Ensure that the policy covers doctor visits, hospital stays, emergency treatment, and prescription medications related to your condition. Be sure to check for any exclusions in coverage tied to high-risk activities. This will be detailed in your policy details.

3. Check Policy Exclusions and Limitations

Carefully review the policy details to ensure they cover your specific pre-existing condition before booking. And, check that you are booking within their required time limit to receive coverage.

4. Consider a Higher Coverage Limit

Medical expenses can be steep, especially in destinations with expensive healthcare systems like the U.S. or Switzerland. Choose a policy with high coverage limits for financial protection. On Squaremouth, it’s easy to select higher medical coverage in the search criteria.

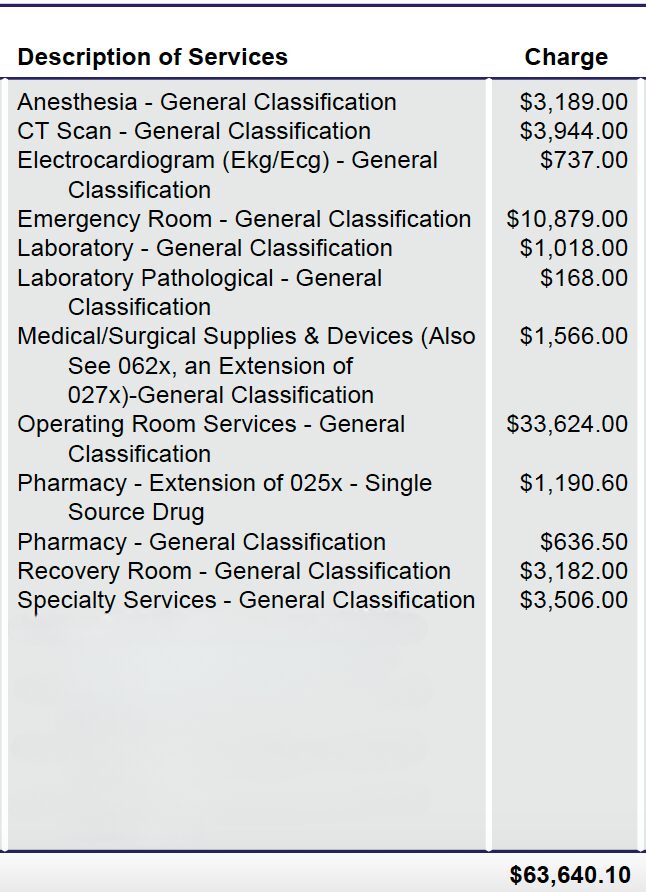

While not related to pre-existing conditions, we wanted to share an actual example of unplanned medical costs in the United States. The image below shows costs from a 2024 emergency room visit and surgery in the U.S. for a standard case of appendicitis and the resulting appendectomy. With good health insurance coverage, we payed less than US$700 for this bill. Without proper medical insurance though, these costs are staggering.

Recommended Travel Insurance Providers for Pre-Existing Conditions

Several insurance providers offer coverage options tailored for travelers with pre-existing conditions. Search on Squaremouth to find those offering coverage for your specific trip and conditions.

- GeoBlue – Offers pre-existing condition waivers for eligible travelers.

- Allianz Travel Insurance – Provides coverage for pre-existing conditions if purchased within a specified period.

- IMG (International Medical Group) – Offers optional riders for pre-existing conditions.

- Seven Corners – Includes coverage for pre-existing conditions if stability requirements are met.

- World Nomads – Covers certain pre-existing conditions with restrictions.

Final Thoughts on Travel Medical Insurance for Pre-Existing Conditions

If your primary medical insurance doesn’t cover you at your destination, obtaining travel medical insurance is essential for peace of mind and financial security. A medical emergency related to your pre-existing condition can be costly and stressful, but the right insurance policy enables you to receive the care you need while protecting you from exorbitant expenses. Before purchasing a plan, compare options, read the fine print, and select a policy that best meets your needs for a worry-free travel experience. Don’t forget to include your travel medical insurance costs in your trip budget planning!

Please pin this for later!

Travel Resources

We recommend booking through our preferred travel booking sites below.

| Air Travel | SkyScanner |

| Lodging | Booking.com, VRBO.com, Expedia.com, Hostelworld |

| Tours and Activities | Viator.com, GetYourGuide.com, TakeWalks.com |

| Car rentals | Discovercars.com |

| Travel insurance | Squaremouth |

| Bike and scooter rentals | BikeBookings.com |

| Train tickets | Trainline, RailEurope |

| Bus tickets | Flixbus, Busbud |

I never thought to look at pre-existing conditions for travel insurance. Thanks for the tips!

Thank you for the feedback

Always take travel insurance. I now plenty of people really being taken for a ride when they were assured that health insurance from back home covers “reasonable cost” due to bilateral agreements then to find out that a pretty standard medical treatment isn’t included because the hospital was a private one… always take out comprehensive travel health insurance!

Thanks, I agree!

I am so shocked by this medical bill you shared. I just realized that the last time I visited the States, I had private European insurance that only included basic emergency coverage. Thank God nothing happened! I will definitely check out Squaremouth, as I’ve never heard of them before.

Yes, unfortunately hospital costs are quite expensive in the U.S. Always good to be prepared, though hope you never need it.

This is a great post and a reminder to take our medical supplies in the original bottles I use Allianz Travel and I like that you have listed other providers who accept pre-existing medical conditions. Indeed, a helpful post.

Thanks for the feedback!

Advice you don’t often consider or think about because you never expect to have an emergency.

Very true

Lots of great tips! It can be stressful trying to find the right insurance, especially if you have special considerations.

Thank you for the feedback.

I wish I read this before our last family trip! Luckily nothing went wrong, but we were traveling with my son’s autoimmune medication and easily could have misplaced it. Thanks for the info!

Thank you for the feedback.

Wow, this is such a helpful post! I feel like this is not something many people think about when they’re planning to travel. Great post.

Thank you for your feedback.

It’s so nice that you can compare policies side by side! As someone from the US, I know how easily even small health issue can deplete your savings in no time. Always always travel with health insurance!

Thanks for the feedback!

Great advice.. I will add that I bring my most important meds in their original bottle.. it helps with knowing the dosage and once I was even allowed to keep the med because it was in the original bottle, otherwise, I would have been forced to throw out the medication by customs.

Great point! I know a lot of people do combine their meds to save space when traveling. For anything prescription in particular, they should absolutely be in the original bottle (for airport security and also in case you need to show it to a doctor while traveling).

Great info! It’s always so stressful to figure out what you really need. Hope this helps more people feel safe traveling!

Thanks for your feedback!

Important planning tips! You never know when you’ll need it. I needed medical attention for the first time while traveling recently in Austria, but didn’t know what my plan covered and was scared of the bill so I left the hospital without being admitted. When I got back home to the US I went to the doctor and turns out my arm was broken. Will be better versed in my medical coverage overseas for sure next time….

We also learned more about medical care abroad when we actually needed care. A bit late, but now we’re prepared when we go.

This is really an important topic for us! My husband recently had a series of knee surgeries and it came into play to need special help while traveling. I appreciate your insight!

Thank you for the feedback, and hope traveling goes smoothly after these surgeries.

Travel insurance is so important – but tricky with a pre-existing condition. This is an awesome post and I didn’t even think about the extra coverage option. Great tips!

Thank you!

I agree that it’s always a great idea to be prepared when traveling. Travel insurance will protect you in case something goes awry on your trip. This is a helpful post on how to choose the best policy.

Thank you for the feedback.

I think this is an interesting angle, as we have another aproach when we already have a medical condition and getting the right insurance is not that easy. Interesting article !

Thank you for the feedback!

As someone with asthma, this is so important and it’s difficult to get it right!

Great information! I have used World Nomads travel insurance, but luckily didn’t need to actually use it!

World Nomads is very good, we just haven’t used it because we haven’t found the pre-existing condition coverage we needed.

This is incredibly helpful and I plan on passing this post along to travelers I know whom could really use this info!

Thanks!

Great tips! Travel insurance is often overlooked but so important. Thank you for sharing this information.

Thank you for the feedback!

Great post on how to get travel medical insurance when you have preexisting conditions. Most insurance costs go up and make it difficult when you mention existing medical issues. Thank you for all your tips.

Thank you for the feedback.

Learning about how pre-existing conditions can impact the value of trip insurance is really helpful. Thank you for highlighting this issue.

Thank you for the feedback

Really helpful breakdown! Travel insurance with pre-existing conditions can be so tricky, but this makes it much clearer. Thanks for the great tips!

Thank you for the feedback